It’s tax season, but we’ve got some great news.

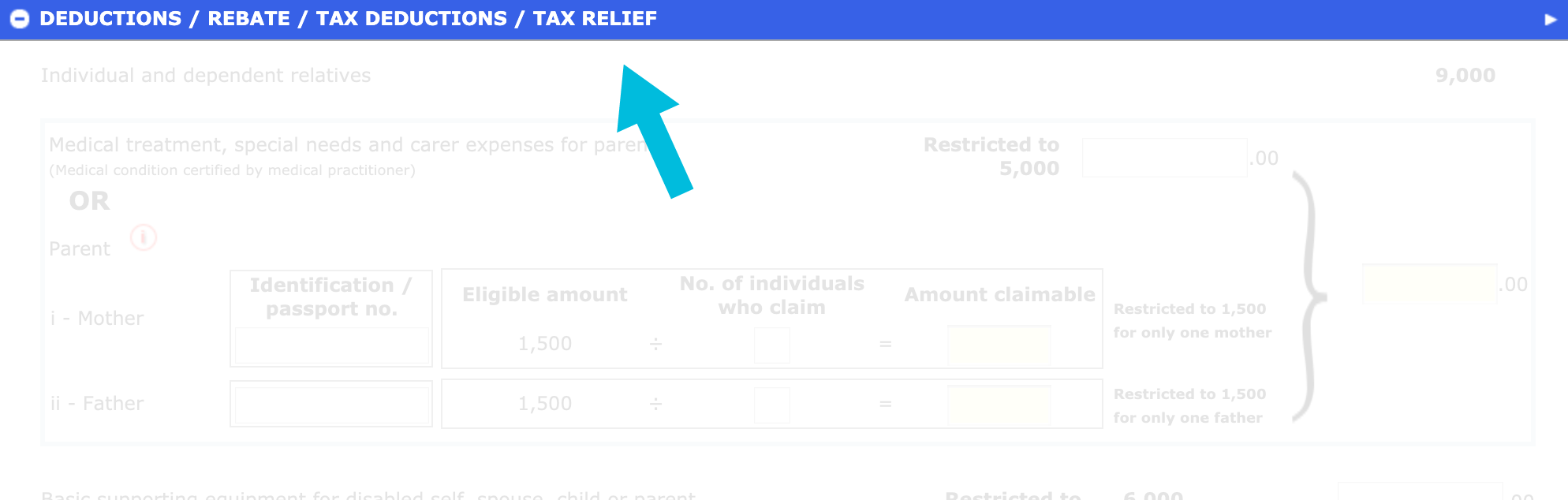

Did you buy life insurance in 2019? If so, here’s the good news. You are entitled to a tax relief of up to RM3,000 on the life insurance premiums you have paid in 2019. So when you file your taxes, don’t forget to claim this tax relief under the tax relief section (see pic below)

If you had bought a critical illness rider in addition to your life insurance, the premiums are also eligible for tax relief. Do note though that the maximum relief remains the same at RM3,000 for all your life and critical illness policies.

This tax relief could be worth up to RM900 reduction in your tax bill.

If you’re a “pensionable public servant”, you can claim a combined RM7,000 for your life insurance premiums and EPF paid in 2019.

If you need to check how much premiums you have paid in 2019, please check with your insurance company, who ought to have sent you an annual statement of premiums. For Fi Life customers, you can retrieve it here. If you’re accessing the website for the first time, have your policy number ready to register.

There’s also a separate tax relief for medical insurance. If you have purchased any for yourself, your spouse or children, the premiums you paid are entitled to an additional tax relief of RM3,000.

Note that tax filing deadline is 30th April, 2020 for physical paper filings, and 15th May, 2020 for e-filing (https://ez.hasil.gov.my/CI/).

Filing taxes aren’t fun, but at least these reliefs make it worthwhile. Happy filing!